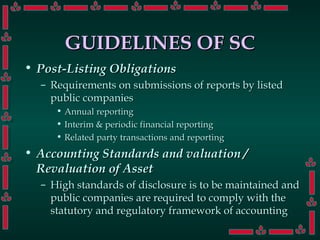

Compliance standards are different and instead are a. Securities Commission Act and regulations b.

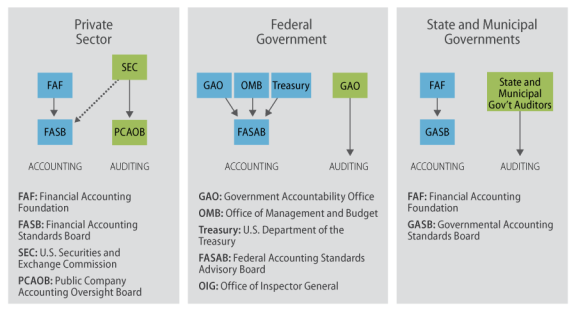

Accounting And Auditing Regulatory Structure U S And International Everycrsreport Com

Under the Act the Malaysian Accounting Standard Board MASB has the authority to set financial reporting standards and statements of principles for financial reporting in Malaysia.

. What is main purpose of a Balance sheet. The accrual system of accounting must be used. Interest royalties contract and other service fees lease rentals for movable property and technical fees.

Accounting Standards are the ruling authority in the world of accounting. GBEs apply approved accounting standards which are issued by the Malaysian Accounting Standards Board MASB either MFRS or MPERS. Compliance and enforcement of MASB standards.

Some accounting firms in Malaysia also provide bookkeeping. You can learn more about financial analysis from the following articles. MASB - Malaysian Accounting Standards Board.

May range from RM4000-RM7000 per month depending on the level of experience Smaller companies may choose to either employ a full-time bookkeeper or to hire a part time bookkeeper to enter the transactions of the company into accounting software. Companies are liable to pay withholding tax on the following types of payment made to a non-resident. Withholding tax rates are 10 15 or 20 of the gross payment.

Finance Cost Accounting Q1List out the differences between funds flow and cash flow statement. Effective 1 January 2020 registered foreign. Statutory reporting requirements.

Here is the summary of accounting standards issued by the ICAI as well as Companies Accounting Standards Rules 2006 notified by the Ministry of Corporate Affairs Government of India. It makes sure that the information provided to potential investors is not misleading in any way. List of Mandatory Accounting Standards in detail.

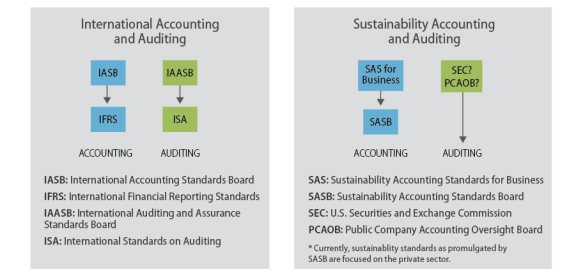

Malaysia Accounting Standards Board and MASB mean the entity established under the Financial Reporting Act 1997 to adopt and issue accounting standards referred to in paragraph 3 of Schedule 3 to this Agreement. The role of the International Accounting Standards Board IASB and the International Federation of Accountants IFAC The Regulatory Framework. Provide professional advice related to your business set up operation and Malaysia rules compliance include company incorporation accounting payroll and etc.

MPSAS 1 defines GBEs as an entity that has all the following characteristics. Explain the rules and regulations of International Accounting Standards. Accounting Standards provides rules for standard treatment and.

Accounting standards relate to a set of rules used to record financial transactions and estimates within the entitys books. Salaries of accountants in Malaysia. 1 Attains Uniformity in Accounting.

Here we also explain the golden and modern accounting rules with examples. 1 Finance Cost Accountinginfo_at_casestudyhelpi n91 94220-28822 2. As part of this process every debit should be matched with a credit and vice versa.

In Malaysia on 1 July 1997 an independent accounting standard setting body was established under the Financial Reporting Act 1997. Let us take a look at the benefits of AS. Is an entity with the power to contract in its own name has been assigned the financial and operational authority to carry on a business.

The Generally Accepted Accounting Principles GAAP is a group of accounting. These standards are followed by the preparers and auditors of financial statements along with other. Basic Accounting Principles and Guidelines These 10 guidelines separate an organizations transactions from the personal transactions of its owners standardize currency units used in reports and explicitly disclose the time periods covered by specific reports.

MASBs standard setting process. An accounting standard is a principle that guides and standardizes accounting practices. Q2Explain the rules and regulations of.

Prepare your company financial report compliance with Malaysia rules and regulation include GST MPERS MFRS and etc. 18A 20 20A Jalan Sasa 2 Taman Gaya. The accountant assumes that a business will continue to operate forever and will have no end date.

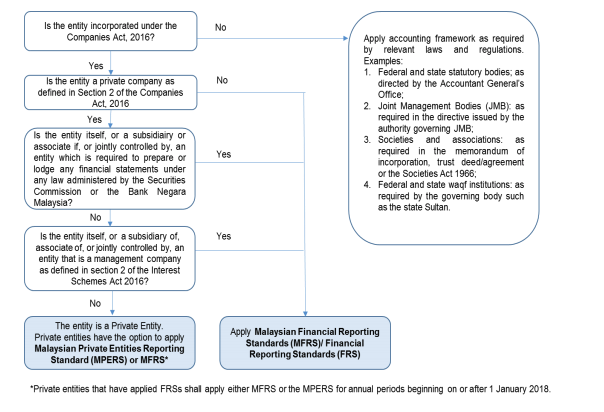

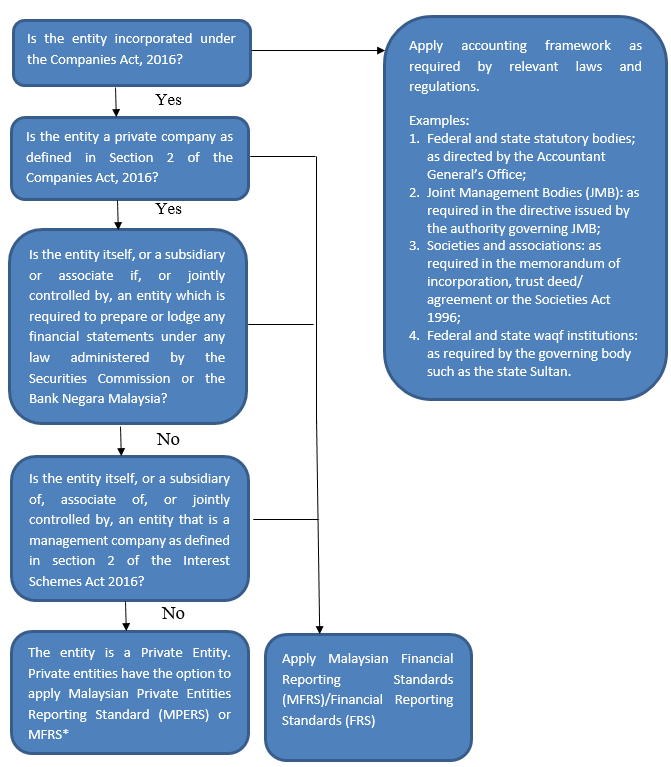

Malaysian Private Entity Reporting Standards MPERS MPERS are mainly utilized by companies that are not publicly listed or have their loan notes or shares publicly traded. Benefits of Accounting Standards. Accounting Standard Rules And Regulations In Malaysia - Setting The Financial Accounting Standards In Malaysia The Malaysian Accounting Standards Board Masb And The Accounting Profession 1997 1999 Semantic Scholar - The family and medical leave act a federal law that allows employees to take time off work for medical conditions and specific family.

Accounting In Malaysia Accounting Requirements For Malaysia Companies

Accounting 101 Financial Reporting Frameworks In Malaysia Theaccsense

Accounting 101 Financial Reporting Frameworks In Malaysia Theaccsense

Lecture 1 Introduction To Accounting What Is Accounting

An Idiot S Guide To Accounting Standards In Malaysia

Principles Objectives Of Accounting Standards

Lecture 1 Introduction To Accounting What Is Accounting

An Idiot S Guide To Accounting Standards In Malaysia

Accounting And Auditing Regulatory Structure U S And International Everycrsreport Com

Accounting In Malaysia Accounting Requirements For Malaysia Companies

Overview Of Financial Reporting Environment

Accounting And Auditing Regulatory Structure U S And International Everycrsreport Com

Accounting Standard L Co Chartered Accountants

Pdf Investigating International Accounting Standard Setting The Black Box Of Ifrs 6

Pdf Malaysian Private Entities Reporting Standards Benefits And Challenges To Smes

Accounting In Malaysia Accounting Requirements For Malaysia Companies

Pdf Malaysian Financial Reporting Standard 139 Financial Instruments Recognition And Measurement Adoption And Intellectual Capital Performance Evidence From The Malaysian Financial Sector